Estimated Tax Payments 2025 Mailing Address

Estimated Tax Payments 2025 Mailing Address. If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you. You'd expect to owe at least $1,000 in taxes for the current year (after subtracting refundable.

View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you.

A Foreign Country, American Samoa Or Puerto Rico (Or Are Excluding Income Under Internal Revenue Code 933) , Or Use An Apo Or Fpo.

Make a same day payment from your bank account for your.

You Can Meet This Requirement Through.

Individuals and businesses impacted by the san diego county floods qualify for an extension to pay their april estimated tax payment.

Alternatives To Mailing Your Estimated Tax Payments To The Irs;

Images References :

Source: www.dochub.com

Source: www.dochub.com

Minnesota estimated tax voucher Fill out & sign online DocHub, Use this address if you are not enclosing a payment use this address if you are enclosing a payment; If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you.

Source: www.dochub.com

Source: www.dochub.com

Oklahoma estimated tax Fill out & sign online DocHub, Search by state and form number the mailing address to file paper individual tax returns and payments. You can meet this requirement through.

Source: traxiontax.com

Source: traxiontax.com

Estimated Tax Payments The Benefits of PrePayments Traxion Tax, How to use the irs. In most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2023, after subtracting any withholding or credits you might have.

Source: ismacaroline.blogspot.com

Source: ismacaroline.blogspot.com

2020 estimated tax payment calculator IsmaCaroline, See what you need to know about estimated tax payments. In most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2023, after subtracting any withholding or credits you might have.

Source: www.pinterest.com

Source: www.pinterest.com

Form 1040 ES, Estimated Tax for Individuals Internal Revenue Service, See what you need to know about estimated tax payments. A foreign country, american samoa or puerto rico (or are excluding income under internal revenue code 933) , or use an apo or fpo.

Source: www.dochub.com

Source: www.dochub.com

Kentucky estimated tax voucher 2023 Fill out & sign online DocHub, How to use the irs. Use this address if you are not enclosing a payment use this address if you are enclosing a payment;

Source: dl-us.com

Source: dl-us.com

The USIRS to extend the taxation due date from April to May 2021, In most cases, you must pay estimated tax for 2025 if both of the following apply: And you are enclosing a payment use this address;

Source: blanker.org

Source: blanker.org

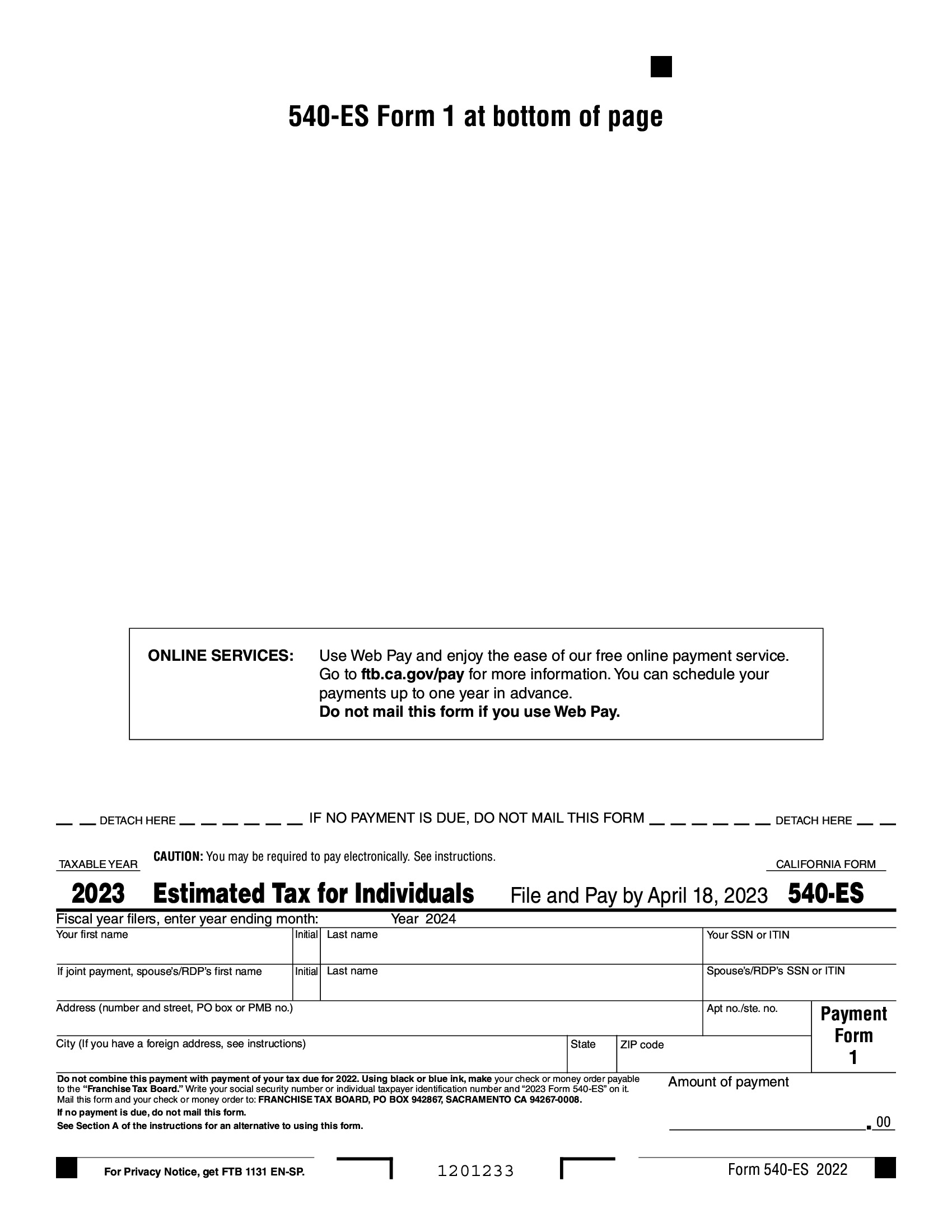

FTB Form 540ES. Estimated Tax for Individuals Forms Docs 2023, Alternatives to mailing your estimated tax payments to the irs; How to make estimated tax payments and due dates in 2025.

Source: tax.thomsonreuters.com

Source: tax.thomsonreuters.com

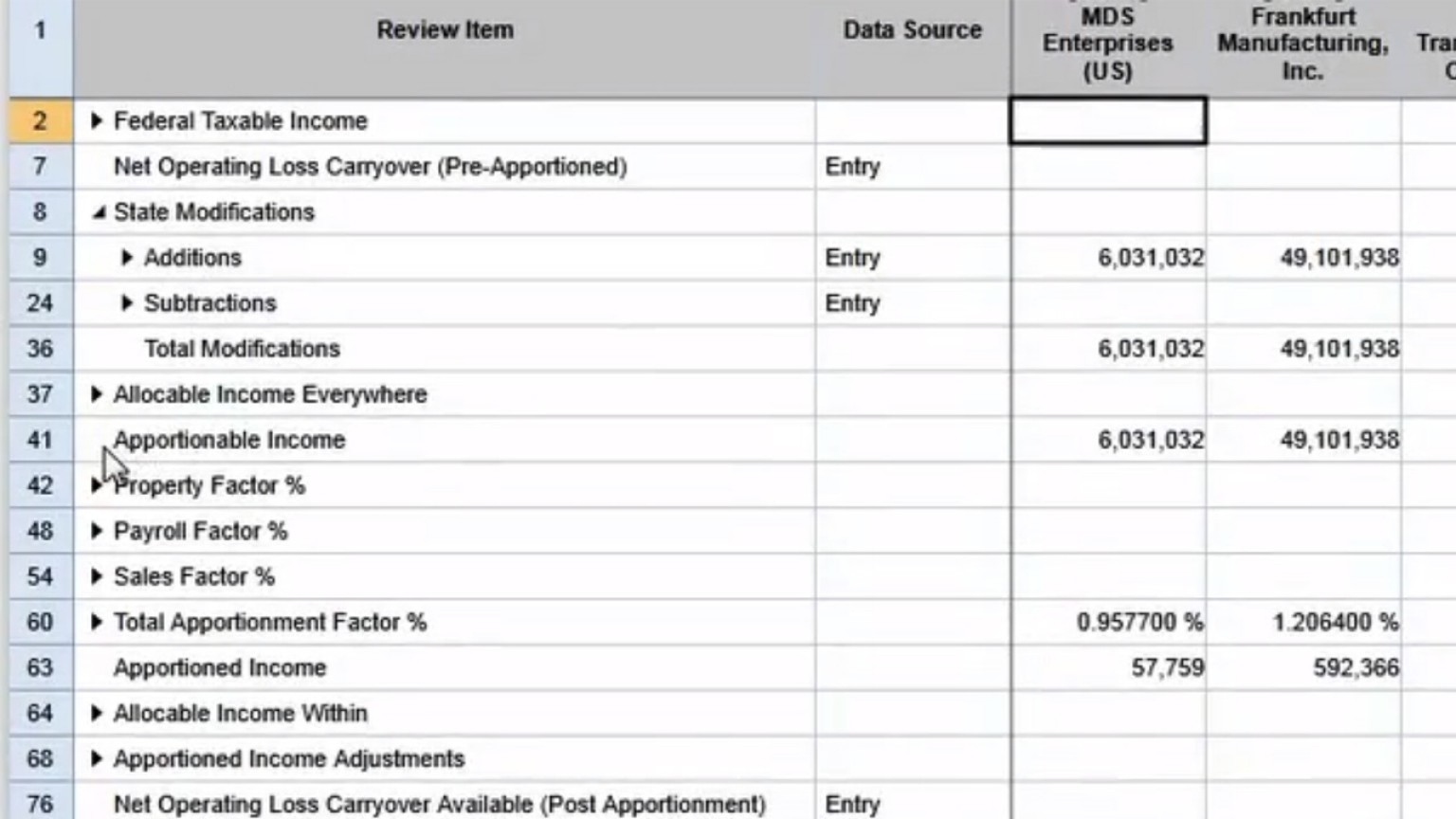

Estimated tax payments software by Thomson Reuters ONESOURCE Thomson, In most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2023, after subtracting any withholding or credits you might have. ‣ how do i calculate and keep track of the estimated tax payments being sent.

Source: www.formsbank.com

Source: www.formsbank.com

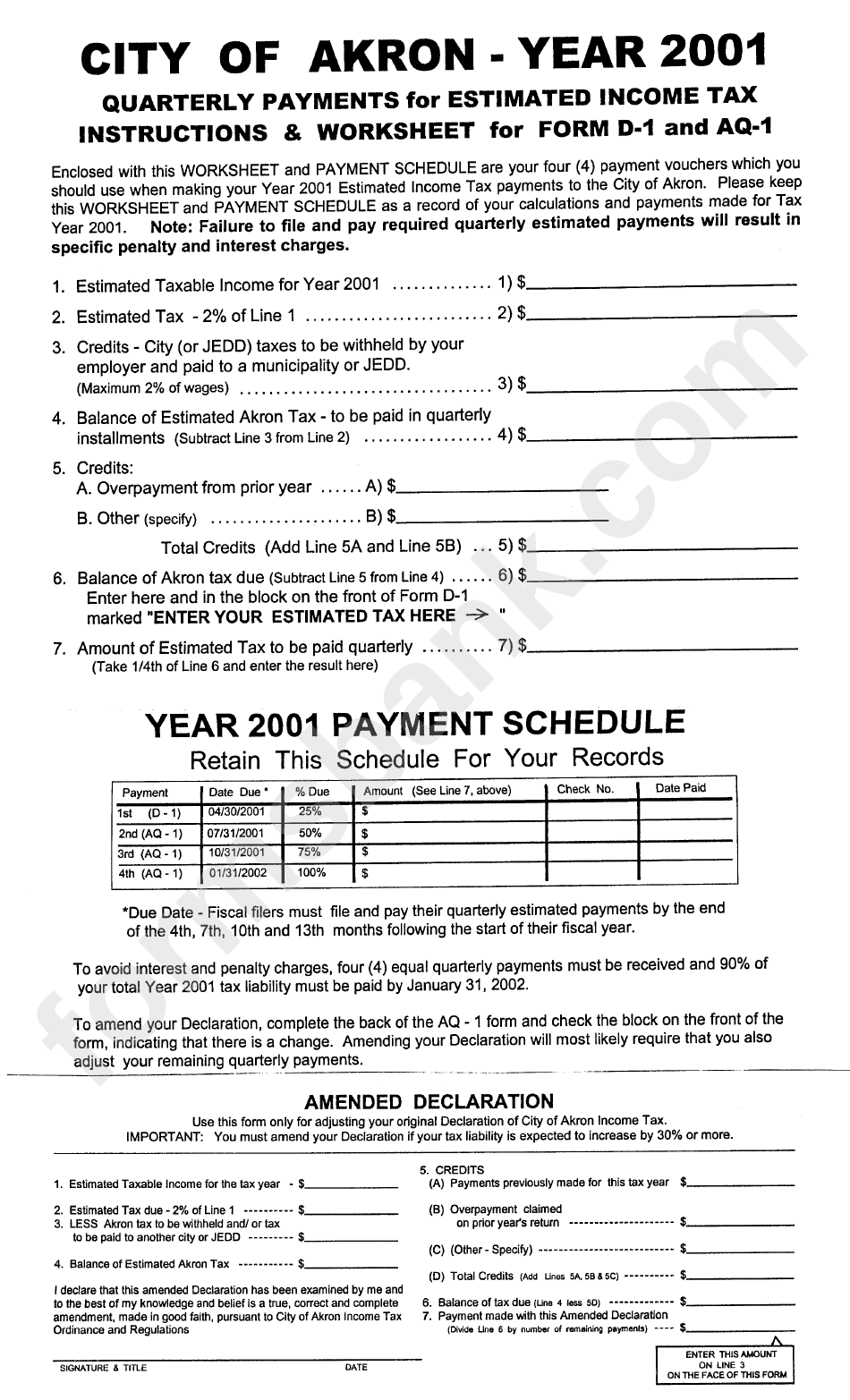

Quarterly Payments For Estimated Tax Form printable pdf download, Use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2025 by mail. You'd expect to owe at least $1,000 in taxes for the current year (after subtracting refundable.

Possession Or Territory*, Or Use An Apo Or Fpo.

This helps in avoiding penalties.

‣ How Do I Calculate And Keep Track Of The Estimated Tax Payments Being Sent.

How to make estimated tax payments and due dates in 2025.